As governments worldwide continue to respond to shifting economic landscapes, understanding the new policy impact on your daily expenses is more crucial than ever. Recent reforms introduced in the latest fiscal budgets aim to recalibrate tax systems, adjust subsidy schemes, and reshape social benefit structures—directly influencing household budgets across various income tiers. Whether you’re a salaried employee, a small business owner, or a retiree, grasping how this new policy will affect your financial health can help you navigate your expenses with prudence and insight.

Background & Context

In the wake of growing inflationary pressures and evolving employment patterns, governments have increasingly sought to implement policies that stabilize economies while promoting sustainable growth. The new policy impact emerges from commitments made in recent budget presentations, designed to balance fiscal responsibility with social equity. This includes modifications in income tax rates, subsidies on essential commodities, utility tariffs, and conformance to international trade agreements that indirectly influence consumer prices.

To place these reforms in perspective, it is essential to revisit the broader economic environment that precipitated such changes. Post-pandemic recovery phases have been marred by supply chain disruptions and geopolitical tensions, which escalated costs of goods and services. Consequently, these newly introduced policies seek to mitigate persistent inflationary trends and redirect financial relief toward vulnerable segments of society.

Detailed Analysis of the New Policy Impact

Income Tax Revisions and Their Repercussions

A central feature of the latest budget alterations is the recalibration of income tax slabs. While certain segments receive relief through increased exemption limits, others face higher rates due to bracket adjustments or removal of specific deductions. These changes carry a multi-dimensional new policy impact that can either expand disposable income or compress it, depending on the tax bracket individuals belong to.

For example, middle-income earners might benefit from simplified compliance and direct tax benefits, but not without relinquishing certain deductibles previously available. Conversely, higher-income individuals encounter steeper marginal rates designed to enhance revenue mobilization without stifling economic activity.

Subsidies and Price Controls: Who Gains and Who Pays?

The government also announced recalibration of subsidies on items such as fuel, food staples, and healthcare services. While the intent is to maintain affordability for low-income households, upward revisions in subsidy caps signal an impending hike in retail prices, especially in urban markets. This carefully calibrated approach epitomizes the delicate balance governments must maintain between fiscal prudence and populist demands.

To understand these shifts better, examining reports from trusted sources such as International Monetary Fund research on subsidy effects can provide valuable insights on how subsidies shape consumption patterns and inflationary dynamics.

Energy Tariffs and Utility Costs

Energy pricing reforms have surfaced as another critical element in the new policy impact matrix. Phase-wise tariff rationalization, aligned to market rates, suggests consumers will experience heightened utility bills over the coming months. However, targeted relief programs have been concurrently introduced to protect low-income households from abrupt shocks.

These changes necessitate greater attention to energy consumption habits and possibly adoption of energy-efficient appliances to mitigate growing costs. Moreover, emerging trends in renewable energy subsidies might alleviate long-term household energy expenses, albeit after initial investments.

Expert Perspectives on New Policy Impact

Eminent economists and policy analysts underscore that while the new policy impact might appear daunting, it represents a necessary pivot towards a more sustainable fiscal framework. Dr. Anjali Mehta, Senior Economist at the National Institute of Public Finance, points out that “the incremental tax burden on higher earners, coupled with targeted support for the vulnerable, aims to foster equitable growth while controlling inflation.”

Meanwhile, consumer rights advocates caution that “price adjustments in critical sectors such as fuel and food need constant monitoring to ensure subsidies reach genuine beneficiaries and do not inadvertently exacerbate inequalities.” These assessments are corroborated by studies from Brookings Institution, which emphasize the importance of effective policy implementation post-budget announcements.

Implications & Impact on Household Finances

The practical ramification of these policies are most evident in household financial statements. For many families, the new policy impact translates into higher immediate expenditures—whether through incremental fuel costs, increased tax deductions, or escalated healthcare charges. Budgeting strategies will need recalibration, emphasizing prudent spending and heightened financial planning.

On the other hand, salaried individuals falling within specified income slabs may benefit from tax reliefs, potentially offsetting increased living costs. Small and medium enterprises (SMEs) also face an evolving environment: while certain inputs may become costlier, availability of incentives under the new framework could foster business resilience.

Financial advisors recommend revisiting investment portfolios and insurance coverage in light of these changes. Also, consultation with recognized bodies such as Consumer Financial Protection Bureau can aid individuals in adapting to new fiscal challenges effectively.

Future Outlook: Navigating the New Economic Terrain

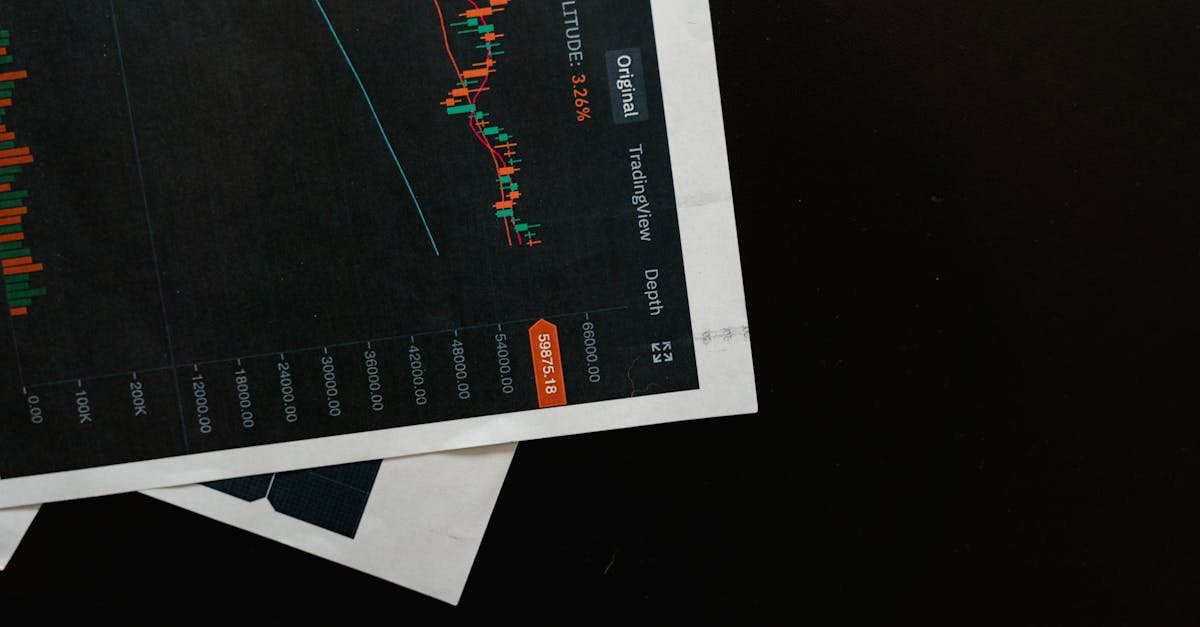

Looking ahead, the new policy impact is set to evolve alongside global economic trends and domestic fiscal priorities. Continued policymaker vigilance on inflation, employment statistics, and international trade will shape subsequent reforms.

Technology integration in governance and transparency in subsidy targeting are expected to improve policy efficacy. Furthermore, expansion of digital payment ecosystems and financial literacy campaigns will empower citizens to better manage their daily expenses amidst these reforms.

Conclusion

In sum, the new policy impact on daily expenses paints a complex but navigable picture. While certain aspects will lead to increased costs, others provide relief and structural benefits aimed at long-term fiscal sustainability. Awareness and adaptability remain key for individuals and businesses alike to thrive in this changing economic environment.

By staying informed through credible sources and employing sound financial strategies, you can mitigate adverse effects and harness new opportunities borne of these reforms.

For more updates on Economy, stay tuned to our latest coverage.